Our experts in company formation in Japan are specialized in forming all types of companies in this country. Our team of incorporation agents can help you open a company in any major city in Japan, for example in Tokyo – it’s capital city or in Nagoya.

Investors from all over the world are interested in opening a company in Japan, due to many business advantages. The Japanese legislation doesn’t require a minimum share capital for the registration of a limited liability company. Japan is famous for its pro-business atmosphere, proficient in attracting wide-ranging overseas funds and important foreign businesses. Japan promotes research and development and has a good percentage of its GDP dedicated to research and development activities. The country has one of the largest and most complex economies in the world and is also considered a competitive country to do business in.

| Quick Facts | |

|---|---|

| Types of companies |

Limited liability company (LLC) Stock company Partnerships (limited or general) |

|

Minimum share capital for LTD Company |

JPY 1 |

|

Minimum number of shareholders for Limited Company |

1 |

| Time frame for the incorporation |

2-4 weeks |

| Corporate tax rate | 30-35% including the local taxes |

| Dividend tax rate |

20.42% in case of resident companies |

| VAT Rate |

10% standard rate 0% and 8% reduced rates *the rates herein include the combined national and local taxes |

| Number of Double Taxation Treaties (approx.) | 78 |

| Do you supply a Registered Address/Virtual Office? | Yes |

| Local Director Required | No |

| Annual Meeting Required | Not required for the LLC |

| Redomiciliation Permitted | Not specifically defined |

| Electronic Signature | Yes, with certain exceptions |

| Is Accounting/Annual Return Required? | Yes |

| Foreign-Ownership Allowed | Yes |

|

Any Tax incentives (if applicable) |

Tax credits for R&D activities Tax incentives/support for R&D activities according to business size and subject to conditions |

There are several types of companies available for incorporation that present different advantages for investors. Our team of company incorporation agents in Japan can help businessmen open any type of company in this country. In case you need other types of services, for example immigration assistance when moving to the Netherlands from Japan, we can put you in contact with our partners.

If you want to open a business in Korea or other country, we can put you in touch with our local specialists.

Types of companies in Japan

The main types of companies in Japan are the corporations and the partnerships. Joint stock companies and limited liability companies are preferred corporate forms while those investors who share similar business goals prefer the general partnership. The limited liability partnership is a convenient business form for those investors who require the limited liability protection as in the case of a company but still wish to operate under a partnership.

Foreign investments are encouraged in Japan and there are a few formal restrictions on investment in selected economic sectors. Investors need to give special notifications when they plan on making an investment in business fields like broadcasting and telecommunication, aerospace, aviation, maritime transport or nuclear energy. The Government may restrict investments in these special areas if it believes that such actions would threaten the national security or the public order. The Foreign Exchange and Foreign Trade Law offers details on investments for special categories of foreign direct investment.

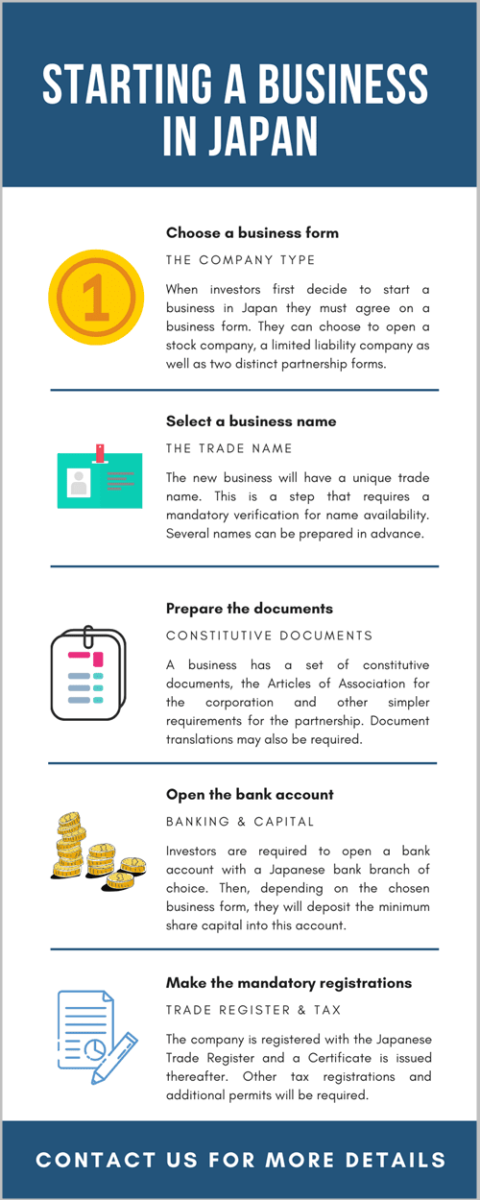

Company formation in Japan requires a few formalities. The steps we present here apply for incorporating a limited liability company in Japan. This is the most common business type found in this country. Investors who would like to open this type of company in an European country, for example form a company in Cyprus can receive assistance from our partners.

The “godo gaisha”, is the Japanese equivalent of the limited liability company in which the members are only liable to the extent of their contributions to the company’s capital. The New Companies Act is the main legal resource that regulates this type of business, as well as the other types of companies that are available for incorporation and the process for setting up a company in Japan.

Investors who want to start such a company in Japan must know that the “godo gaisha” does not have a minimum share capital requirement when it is registered, however, the member’s contributions can only be made in cash or non-cash assets and not in services.

We can give you details on your options for immigration to Japan as an entrepreneur.

Company formation steps in Japan

Starting a company in Japan requires several steps. Those for opening a limited liability company are the following:

- a manager who can be a natural or corporate body must be chosen by the company members in order to act on behalf of the company and their interests;

- the next step in company formation in Japan is making the company seal, while the company representative is required to register for a personal seal;

- then, the company’s Articles of Association must be registered with the Japan Legal Affairs Bureau, via a standard application;

- if all the documents are in order and the application is approved, the certificate of seal registration is then delivered to the Legal Affairs Bureau;

- the next step is submitting notifications for tax, payroll and the approval of blue tax returns to the District Tax Office – this must be completed within a month;

- when hiring employees in Japan, the company must register at the Labour Standards Inspection Office for labor and health insurance and public welfare pension;

- the last step implies submitting an application to the Public Employment Security Office no longer than 10 days after hiring the first employees.

The registration of a company in Japan takes less than ten days when all the documents are in order. Subsequent special permits and licenses may be needed.

Our experts in company formation in Japan can help businessmen with the process of drafting important documents necessary in order to open a company in Japan, such as the Articles of Association.

Do you want to start a business and remain in Japan to manage it? Our team can also give you information about the business manager visa which is required in case of foreign nationals who wish to enter the country. acquiring Japanese residency based on a business investment is subject to certain pre-defined conditions and our team can help those interested with more information, according to their situation.

Our immigration lawyers in Japan can give you details about the visas that allow you to remain in the country to open a company.

If you want to set up a company in Japan, we invite you to watch the following video about the company incorporation procedure in this country:

Characteristics of companies in Japan

The following requirements must be complied with when opening a company in Japan:

- A limited liability company in Japan is a type of company suited for small and medium businesses.

- The members are liable only to the extent of their contribution to the company’s capital.

- Unlike the joint stock company, all the members of the company may represent it, until a manager is appointed. Their contribution can be made in cash but also in non-cash assets.

- It’s mandatory that all the company’s members must be in favor of a certain decision to make it applicable.

- A “godo gaisha” may be reorganized as a joint-stock company if all the company’s members agree with the decision.

- All companies in Japan are subject to observing the accounting, filing and auditing requirements.

The Japanese accounting standards apply to all companies (GAAP) and company owners must prepare and submit the financial statements on an annual basis. Companies that have more than 500 million JPY capital are required to appoint an external auditor. The tax year is generally the same as the calendar year, but it may be another twelve-month period, as the company chooses upon its incorporation. Branches are generally required to have the same fiscal year as the head office abroad.

In case you are considering starting a company of this type in Japan, our experts in company registration in Japan can help you.

Company formation requirements in Japan

Both foreign and local entrepreneurs seeking to open companies in Japan must consider the following aspects:

- the company must have a legal address in Japan – this can be secured through a virtual office in the first phase;

- the company will need a resident director who handles the bank account opening;

- the director will also be in charge of depositing the share capital in accordance with the requirements of the Company Law;

- the Articles of Association of the company must be drafted and notarized prior to being filed with the Trade Register; this is a prerequisite to starting a company in Japan;

- other documents may be required for registration, depending on the activities of the company.

Our company formation consultants can represent foreign investors in their relationship with the authorities during the process of company registration in Japan.

There is no mandatory requirement for immigration to Japan for company founders.

The Articles of Association of a company in Japan

The Articles of Association are the most important documents to be prepared when opening a company in Japan, no matter the industry it will operate in. These must contain the following information:

- information about the shareholders and their shares in the Japanese company;

- the company’s trade name, legal address, the object of activity and the purpose of establishment;

- information about the directors of the Japanese company (names and addresses);

- information about the payment of the dividends and distribution of shares;

- the rules related to managing the company and other special provisions.

It should be noted that the Articles of Association must be prepared in accordance with the type of company established. We can help you during this essential step for setting up a company in Japan.

Services provided for registering a company in Japan

- Drafting the Articles of Association (necessary for the company incorporation in Japan); If the investor cannot be present in the country, the Articles of Association for the Japanese company can be signed through a Power of Attorney.

- Drafting all other documents required for the incorporation of the Japanese company; these documents include specimen signatures, special forms provided by the Company Registration Office in Japan, passport copies, etc.

- A registered office in Japan for your company, which is mandatory for all companies registered in the country (the registered office is the chosen address where the Japanese company has its headquarters).

- Setting up a bank account for your Japanese company with a bank of your choosing.

Company registration timeline in Japan

Most foreign investors opening companies in Japan often wonder how much time and money it takes to register the business. Our specialists in company formation in Japan have prepared a timeline related to the procedure of starting a business:

- the company name search and reservation can be completed in a few hours and is free of charge;

- the company seal is done in 3 days and costs around 20,000 JPY;

- opening the bank account takes 1 day and is free of charge;

- the registration with the Trade Register can take up to 3 days and the fee related to this process depends on the share capital of the company;

- the registration with the tax authorities takes 1 day and is free of charge;

- the registration for social security and pension purposes takes 1 day and is also free of charge.

Costs for registering a company in Japan

The costs associated with starting a business in Japan are:

- the company registration cost imposed by the Japanese Trade Register is set at around 50 EUR or 0,7% of the company’s share capital (the higher amount will be considered);

- the virtual office costs start at around 100 EUR per month and depend on the services required by the client;

- the minimum share capital of a limited liability company in Japan is 1 JPY or its equivalent, however, the investor is required to deposit the amount of money considered to start the operations;

- our company formation fees start at 589 EUR and depend on the type of company the businessperson wants to register in Japan;

- the accounting fees start at approximately 100 EUR per month and depend on the size of the company and the services included.

If you need more details about the costs related to starting a business in this country our specialists in company registration in Japan can help you.

Other costs for company formation in Japan

It is very common for foreign investors to appoint company registration agents to incorporate a business on their behalf in Japan. In this case, the costs associated with hiring specialists for opening a business in Japan must also be included.

In addition to the costs that will appear when investor request the services of a company incorporation agent, the costs for hiring personnel should also be included. These mostly relate to the costs for the services offered by a recruiting agency, a common manner in which the business owners select their employees for different positions. These costs can be expressed as a percentage of the first year salary and will differ according to the position for which the recruitment is made (they will be larger for a manager position compared to another type of employee and they will also differ according to the sector in which the company activates).

Foreign investors who have obtained a long-term visa and plan on spending time in Japan in order to manage their company will also wish to include those costs that relate solely to their own expenses while in the country. Although these are not related to the company itself, it can be useful to find out more about the housing costs for a foreign national if you intend to relocate to the country.

Key facts about Japan

The Japanese taxation system is quite elaborate so it is advisable to consult with a tax expert before opening a company and for any accounting and tax filing proceedings;

- Foreign residents are only taxed on the income earned in Japan.

- The taxation of individuals is done according to progressive tax rates, up to 45%. Individuals may be considered permanent residents or nonpermanent residents.

- For individuals, the tax year is the same as the calendar year.

- The equivalent of worldwide VAT in Japan is the Consumption Tax at a rate of 8%. CT registration is mandatory only under certain conditions and for companies that exceed a certain taxable sales amount.

- Foreign investors who want to start a business in Japan, should know that the corporate tax in this country is 23,4 %. Along with the corporate tax, the company must pay two types of local taxes: inhabitant tax and enterprise tax.

- Withholding taxes apply to dividends, interest, and royalties, in different percentages starting from 15% to %, plus a surtax.

- Branches in Japan are subject to the same corporate income tax as local companies.

- Companies must file a corporate income tax return, an inhabitants tax return and an enterprise tax return. The filing and payment deadline is no later than two months after the closure of the fiscal year.

- There are two types of tax returns in Japan: the so-called white ones and the blue ones. The blue tax return has several benefits, among which privileges for accelerated depreciation and a tax loss carryforward. Our agents who specialize in company registration in Japan can help you understand the differences and apply the use of a blue return, if possible in the company’s particular case.

- The tax authority in Japan is the National Tax Agency (NTA). Sources for tax law include the Corporation Tax Law, the Special Taxation Measures Law and the Consumption Tax Law.

- The workforce in Japan consists of well trained, educated and loyal employees.

- The Labor Standards Law includes the provisions for the working hours, the wages and benefits and the employee rights.

- The government offers certain incentives to the companies: for investments related to productivity improvements or for the promotion of income growth. A tax credit for job creation is applicable.

- The industry is very developed, especially in the electronics, machine tools, ships, chemical substances, and motor vehicles.

- Japan’s main export partners are the United States, China, Taiwan, Korea, and Hong Kong. Import partners include the United States, China, Australia, Saudi Arabia, Korea or Malaysia.

- Many financial services companies are located in Japan.

- Japan is a member of the World Trade Organization and has an extensive double tax treaty network wich allows for double taxation relief for corporations that derive income both from Japan and from another jurisdiction with which a treaty is signed. If you would like to start a company in other countries, for example starting a business in USA or Indonesia, we can put you in contact with our partners.

FAQ on setting up a company in Japan

The company registration process in Japan can be quite lengthy and can expand over a few months, depending on the type of company chosen.

Our company registration agents in Japan recommend the limited liability company which can be used for all types of activities and which is best suited for foreign investors.

The share capital requirements depend on the type of company the investor wants to open: one will need 1 USD for a private limited liability company and 6,000 USD in the case of a public company.

Yes, having a registered address in Japan is one of the requirements for setting up a company here.

Yes, foreign investors can also set up offshore companies in Japan. If you are considering starting this type of company and don’t know which country to choose, we recommend you to contact our partners Bridgewest – a firm specialized in offshore company formation matters.

If you do not have a representative director and you do not reside in the country, you can become a representative director yourself by obtaining a business investor visa.

In Japan, there is no minimum capital required. Therefore, in theory, it is possible for you to open a company in Japan with only one yen capital. However, you will have to invest JPY 5 million if you intend to obtain the investor or business manager visa.

In case the capital source is a foreign person who resides in Japan, a seal certificate will be necessary. If the foreign person does not reside in the country, a notarized signature certificate is required. In case the founding source is a foreign company, a notarized copy of the company registry and one of the signing authorities are needed.

A registration tax is mandatory when a company is registered, which is 0.7% of the initial capital of JPY 60,000 for a GK and JPY 150,000 for a KK.There are also other ongoing corporate taxes which will be due. Our experts in company formation in Japan can provide more details on these taxes.

In Japan, you are able to register your home address as your business address.

Indeed, you can register your company in Romanic characters, if you wish.

As the third largest economy in the world, Japan presents political stability, it is a great country to live in and presents numerous tax advantages. For more details on company formation in Japan and investment particularities, please do not hesitate to talk to one of our experts.

Bridgewest provides company registration services in Japan. Please contact us for more information and prices.

You can also contact our immigration lawyers in Japan for details on the types of visas.